Entrepreneurs are everybody’s favourite heroes. Politicians want to clone them. Popular television programmes such as “The Apprentice” and “Dragons’ Den” lionise them. School textbooks praise them. When the author of this blog was at Oxford “entrepreneur” was a dirty word. Today the Entrepreneur’s Society is one of the university’s most popular social clubs.

But what exactly is an entrepreneur? Here the warm glow of enthusiasm dissolves into intellectual confusion. There are two distinctive views. The first is the popular view: that entrepreneurs are people who run their own companies, the self-employed or small-business people. The second is Joseph Schumpeter’s view that entrepreneurs are innovators: people who come up with ideas and embody those ideas in high-growth companies.

Schumpeterians distinguish between “replicative” entrepreneurs (who set up small businesses much like other small businesses) and “innovative” entrepreneurs (who upset and disorganise the existing way of doing things). They also distinguish between “small businesses” and “high-growth businesses” (most small businesses stay small). Both sorts have an important role in a successful economy. But they are nevertheless very different sorts of organisations.

Most people who try to measure how entrepreneurial a society is try to measure the first type of entrepreneurship. They measure the number of small businesses or the number of people who are self-employed or the number of startups. But this produces perverse results. Egypt regularly comes out as more “entrepreneurial” than the United States. It also produces a highly distorted picture of entrepreneurial activity within advanced economies.

In America most self-employed people do grunt-work in highly conservative industries: construction, landscaping, car-repair, restaurant and truck driving for men and cooking, cleaning and beauty salons for women. Most small companies are Mom-and-Pop stores that will always stay in the family. Three-quarters of people who start companies say that they want to keep their companies small enough to manage themselves.

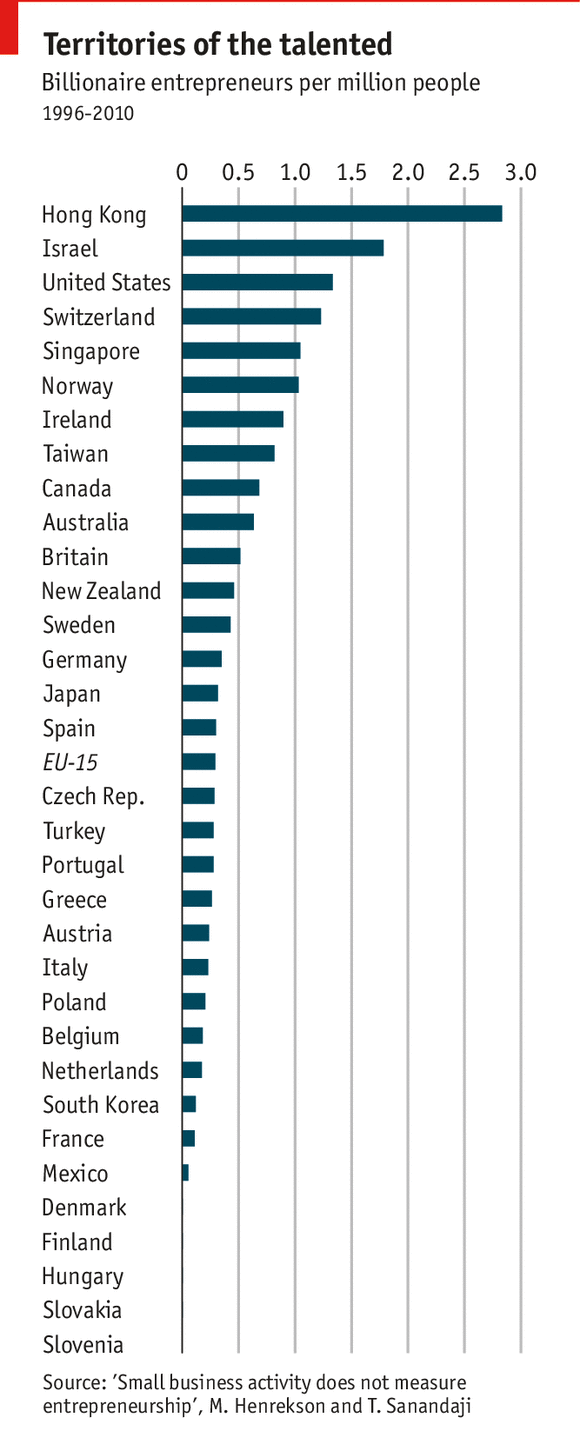

In a new paper Magnus Henrekson and Tino Sanandaji argue that the number of self-made billionaires a country produces provides a much better measure of its entrepreneurial vigour than the number of small businesses. The authors studiedForbes’s annual list of billionaires over the past 20 years and produced a list of 996 self-made billionaires (ie, people who had made their own money by founding innovative companies as opposed to people who inherited money or who had extracted it from the state). They demonstrated that “entrepreneur density” correlates with many things that we intuitively associate with economic dynamism, such as the number of patents per head or the flow of venture capital.

They also demonstrated it correlating negatively with rates of small-business owners, self-employment and startups—in other words that many traditional measures are about as misleading as you can get.

Countries with a lot of small companies are often stagnant. People start their own businesses because there are no other opportunities. Those businesses stay small because they are doing exactly what other small businesses do. The same is true of industries. In America industries that produce more entrepreneur billionaires tend to have a lower share of employees working in firms with less than 20 employees.

This makes sense: successful entrepreneurs inevitably destroy their smaller rivals as they take their companies to scale. Walmart became the world’s largest retailer by replacing thousands of Mom-and-Pop shops. Amazon became a bookselling giant by driving thousands of booksellers out of business. By sponsoring new ways of doing things entrepreneurs create new organisations that employ thousands of people including people who might otherwise have been self-employed. In other words, they simultaneously boost the economy’s overall productivity and reduce its level of self-employment.

Who are the Schumpeterian entrepreneurs who dominate the modern economy? And how do you create more of them? Messrs Henrekson and Sanandaji argue that the majority of the world’s wealthy entrepreneurs acquired their riches by starting a business: 65% in America, 42% in Europe and 52% overall. The list of entrepreneurial hot spots contains a cross-section of countries (see chart), some in the West such as America (ranked at number 3) and Switzerland (4) but also some Asian dragons such as Hong Kong (number one by some way), Singapore (5) and Taiwan (8). Israel (2) is the only country from the Middle East.

Entrepreneurs tend to be highly educated: 45% of American self-made entrepreneurs have advanced degrees, a sharp contrast with the early 20th century, when men like Henry Ford dropped out of school to become tinkerers. They also tend to focus on high-tech and finance. The bulk of American entrepreneurs come from just three clusters: Boston, New York and Silicon Valley. The millionaires may live next door to the average American, as a bestselling book once argued , but billionaires live in their own little enclaves.

The authors are less informative about the second question. They warn that high taxes can encourage replicative entrepreneurship rather than innovative entrepreneurship. The self-employed face lower tax rates than the employed (and can evade taxes more easily). They also face a lower chance of being audited. This encourages companies to stay small and encourages workers to sell their labour to small companies rather than big companies. The same is also true of heavy regulation. They warn that conceptual confusion over the nature of entrepreneurship can also create policy confusion: attempts to boost the number of small businesses can reduce the likelihood that one of those small businesses will outcompete all the others.

Schumpeterian entrepreneurship is all about innovation and ambition to turn small businesses into big ones. Small business entrepreneurship is all about flexible employment and poor opportunities. But the authors have little to say about how to create the network of institutions that they think helps to create entrepreneurship: high-powered universities and dense clusters of activity of the sort that flourish in Boston and Silicon Valley.

Still, if Henrekson and Sanandaji do not provide us with the key to the secret kingdom, they at least make sure that we are trying to get through the right door.

See on www.economist.com

Accelerators & Incubators, accelerateur, incubateur, entrepreneur, entrepreneurship, Executive Business Accelerator, Gilles Bouchard, Harvard Business School, Harvard Business Angels, innovation, Louis Catala, reconversion, startups, Audra Shallal, expertise, entrepreneur investisseur, développement, international, entreprise de croissance, accompagnement cadres et dirigeants, cadres, dirigeants, grands groupes, outplacement, startupper