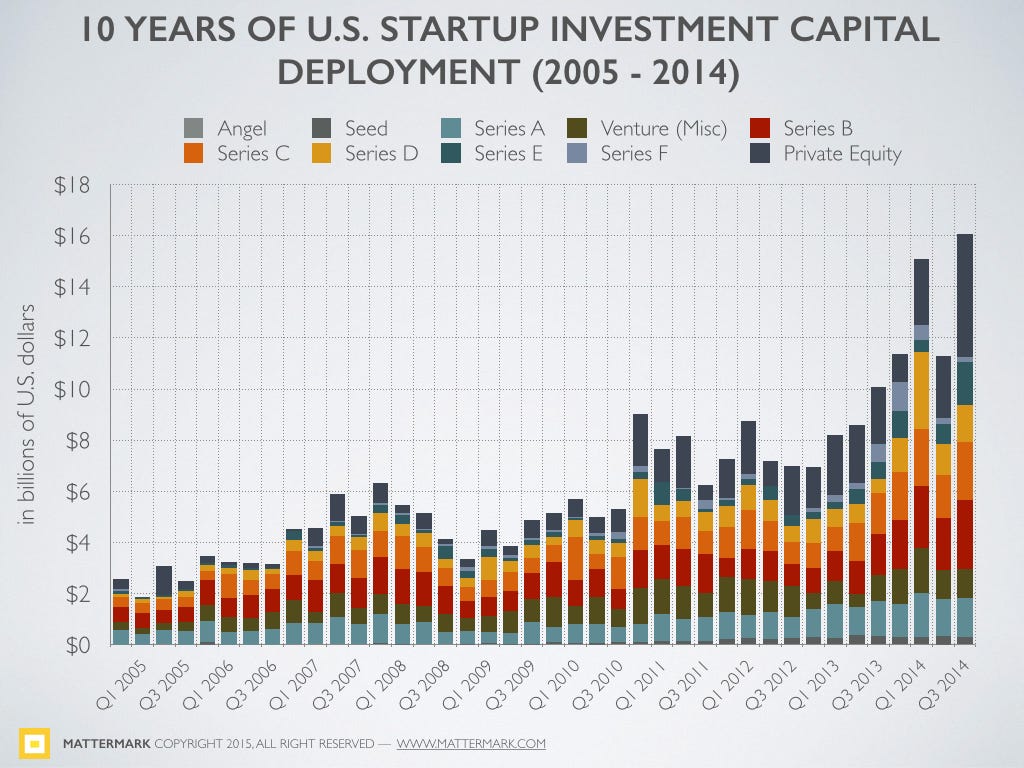

As the research and analysis process for this funding report continues, I find it fascinating to observe the concentration of capital around later stage deals. While discussion of deal volume and bubbly valuations at the early stage is a popular topic of conversation, it is the late stage mega-rounds that have been driving up total dollars invested into startups over the past 3 quarters.

In the fourth quarter of 2014, 11 startups received funding in 12 mega-deals reported to be $100M or more, totaling $4 Billion dollars. Rather than rank them by deal size, this list is ordered by their Mattermark Growth Scores. You can sign in to your Mattermark Professional account or start your 15 day free trial today to explore the underlying metrics.

Mega-Rounds > $100M in Q4 2014

- $165M to Houzz (Series D)

- $1.8 Billion to Uber (Series E and Private Equity respectively)

- $120M to Slack (Series D)

- $220M to Instacart (Series C)

- $150M to Square (Series E)

- $100M to Mirantis (Series B)

- $542M to Magic Leap (Series B)

- $335M to WeWork (Private Equity)

- $185M to Mozido (Series B)

- $100M to Revel Systems (Series C)

- $250M to SurveyMonkey (Private Equity)

If you found this analysis interesting please consider pre-ordering the Startup Funding Report — it’s just $5 for the first 500 orders and the price will increase through the month until we release it at full price.

This in-depth analysis will look at data behind trends like the rise of seed rounds that look like Series As, introduction of micro VC and proliferation of the startup incubator/accelerator model, massive private equity deals replacing IPOs, the changes in timing between rounds, round sizes, geographical distribution of investment and much more.

We will also explore the survival, exit and death rates of startups in different regions, industries and specific investor portfolios.

Source : medium.com

Accelerators & Incubators, accelerateur, incubateur, entrepreneur, entrepreneurship, Executive Business Accelerator, Gilles Bouchard, Harvard Business School, Harvard Business Angels, innovation, Louis Catala, reconversion, startups, Audra Shallal, expertise, entrepreneur investisseur, développement, international, entreprise de croissance, accompagnement cadres et dirigeants, cadres, dirigeants, grands groupes, outplacement, startupper